Real estate has long been touted as a reliable path to financial freedom. It offers consistent rental income, the potential for appreciation, and tax benefits. But what if you could turbocharge your returns? This is where leveraging real estate investment comes in.

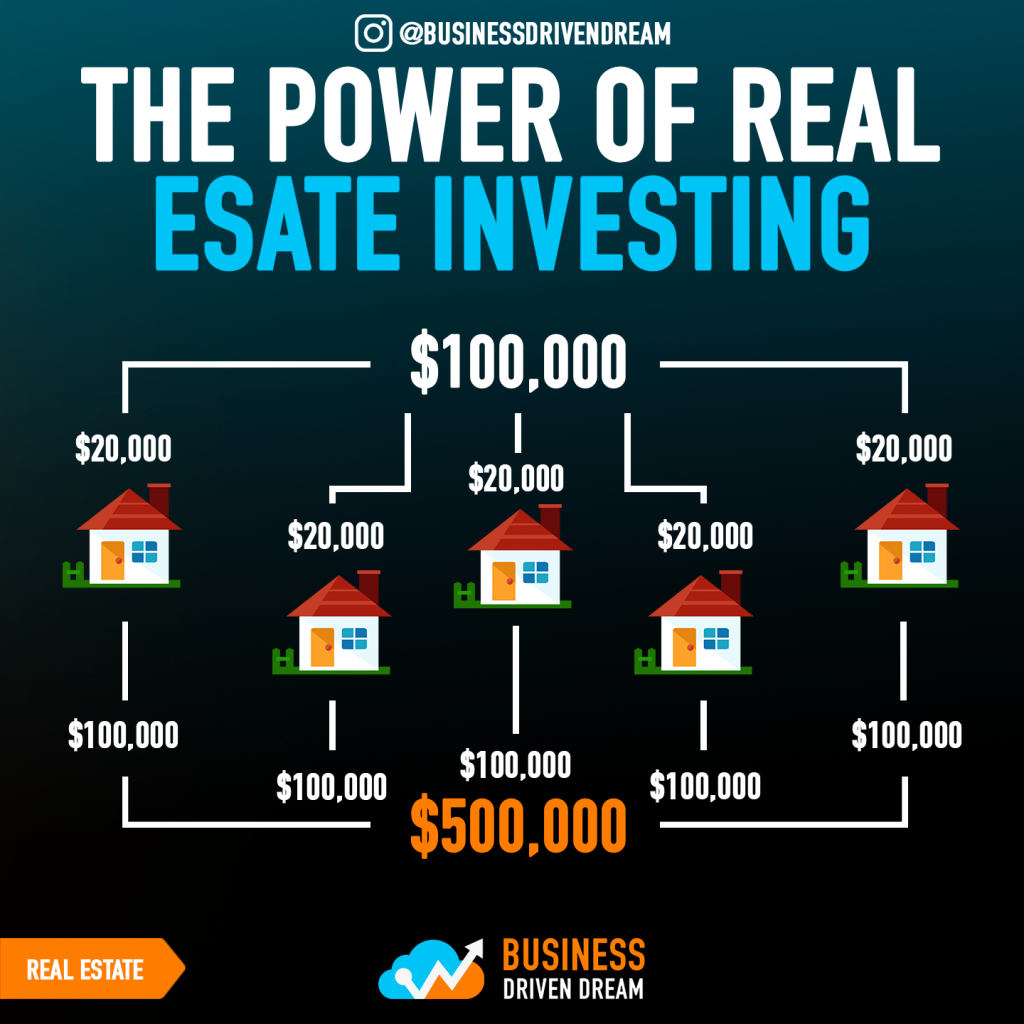

Leveraging essentially means using borrowed capital (debt) to increase your buying power and potential returns. In real estate, it often involves taking out a mortgage to purchase a property. Think of it as using someone else’s money to access a bigger piece of the pie.

But before you jump into a leveraged investment headfirst, let’s understand the advantages and risks:

Pros:

- Amplified returns: A small down payment can unlock a property with potentially significant rental income and appreciation. This can dramatically magnify your initial investment.

- Portfolio diversification: Leverage allows you to invest in multiple properties with less upfront capital, diversifying your portfolio and mitigating risk.

- Equity gain: Rising property values translate to increased equity in your investment, even if you only put down a fraction of the cost.

- Tax benefits: Mortgage interest is typically tax-deductible, further lowering your investment cost.

Cons:

- Increased debt: Leverage amplifies both gains and losses. A downturn in the market can leave you facing significant debt compared to your equity.

- Greater financial strain: Mortgage payments add to your financial obligations, requiring careful budgeting and cash flow management.

- Risk of foreclosure: If you can’t keep up with mortgage payments, you risk losing the property entirely.

So, leveraging is a powerful tool, but it’s not for everyone. Here are some tips to leverage real estate wisely:

- Start small and conservative: Don’t overextend yourself. Begin with a single property with a low loan-to-value ratio (LTV) to minimize risk.

- Focus on cash flow: Choose properties with reliable rental income that comfortably covers your mortgage payments and leaves room for other expenses.

- Prioritize location and property condition: Invest in areas with strong demand and properties in good repair to minimize vacancy risks and maintenance costs.

- Build a strong financial cushion: Ensure you have sufficient savings and reserves to weather economic downturns or unexpected expenses.

- Seek professional guidance: Consult a qualified real estate agent and financial advisor before making any investment decisions.

Remember, leverage is a double-edged sword. Used strategically, it can catapult your wealth-building journey. However, it requires careful planning, risk management, and a healthy dose of financial discipline. If you’re ready to unlock the full potential of real estate, leverage can be your key, but use it wisely and build your investment empire brick by brick.

Bonus tip: Explore alternative options like real estate investment trusts (REITs) or crowdfunding platforms for leveraged exposure without directly owning a property. These might be suitable for those with smaller investment budgets or lower risk tolerance.

By understanding the risks and rewards, you can leverage real estate investment to propel your financial future to new heights. Just remember, the key is to invest responsibly, stay mindful of risk, and build a solid financial foundation for your real estate journey.

Created By:- Bard AI